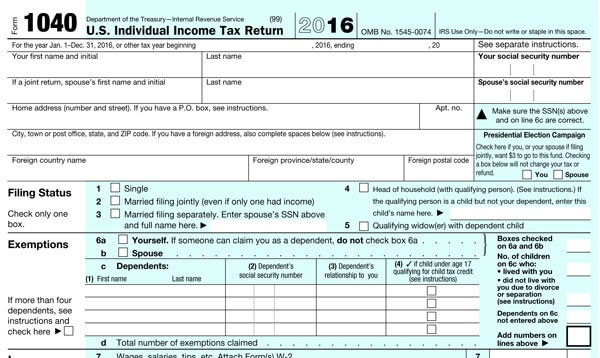

Congress has passed a new tax code. Now it's up to accountants and tax preparers to figure out the new rules

Congress has approved tax cut legislation. Now it's up to the IRS to interpret what that legislation means, so tax preparers and accountants can complete next year's tax returns.

Tuesday afternoon Decorah CPA Kelly Brickley, who has worked at Hacker, Nelson & Co., P.C. in Decorah since 1993, told members of the Decorah Rotary Club, "We're going to be sorting this out for awhile."

But Brickley told his audience there are steps that can be taken before the end of 2017 that will help people in 2018. Since tax rates will be lower next year, Brickley advises to postpone taking whatever income you can postpone until 2018.

Likewise, since the rules for deductions will be tighter next year, Brickley says it would be a good idea to pay deductible expenses in 2017. For instance, if you can prepay property taxes now, it would probably save you money in 2017.

Brickley says the IRS is promising to create new forms for next year and to give tax preparers guidance on interpreting the new legislation. Still, he admits, "It's been really hard to follow."

Site designed and maintained by Iroc Web Design Services©.

Your Small Business Web Design Solutions.™